Industry Insiders: Private Equity

INDUSTRY INSIDERS CONTINUES AS WE EXPLORE OTHERS ROLES IN FINANCE.

For each post in the series, we asked two experienced professionals in different roles to explain exactly what they do in layman's terms.

We covered Research, Investment Banking, and Trading in previous posts and today’s edition will cover Private Equity.

Follow us on on Instagram @atherdesk and subscribe to our newsletter to get updates as we take you inside other industries.

This week, we’re diving into PRIVATE EQUITY.

MA (28 years old) works at a boutique private equity firm and JF (27 years old) works at a large, global financial services company, both in NYC.

Q: What is your official work title:

MA: Senior Associate

JF: Analyst

Q: How would you explain your job to a 15 year old?

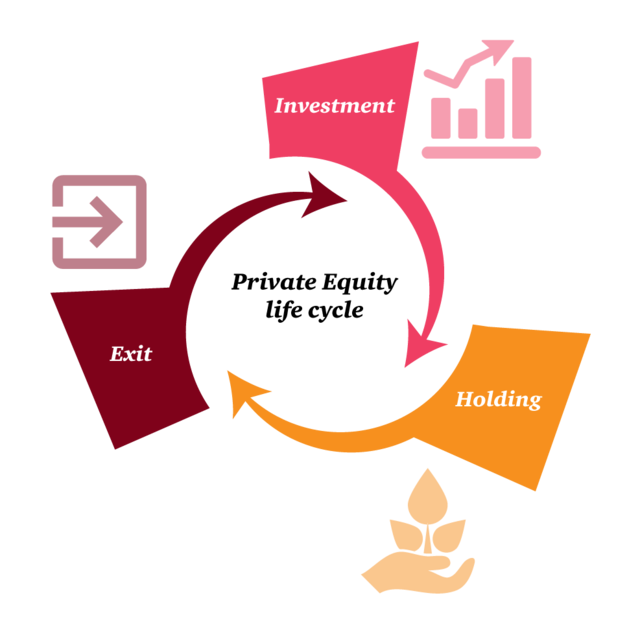

MA: Private equity firms raise funds that pool money from a bunch of investors (e.g., pension funds, governments, crazy rich Asians) in order to invest in private companies (i.e., firms not traded on a public exchange), and typically sell their investment in those companies 3-5 years later. The goal is to turn a dollar invested into two to three dollars in those 3-5 years. We accomplish this in various ways, but generally the idea is to improve the operations of the company to create value. When everything goes well, all parties involved are happy: investors are happy because the money they contributed to the fund has doubled or tripled; the companies that received investment from the private equity firm are pleased because they have likely performed well and grown nicely during the period they partnered with the firm; and the private equity firm and its employees are rewarded with a handsome paycheck.

JF: I identify and analyze companies across all industries to decide whether or not to invest in the companies.

Source: Swanson Capital Group

Q: What are some things/projects you are responsible for?

MA: I spend my days looking at private companies looking for an investment and helping to manage two companies we are currently invested in. Evaluating a new investment opportunity is a robust process that typically takes months. We are effectively trying to learn everything about the industry the company operates in, the company’s competitors and the business itself. I look at dozens of new investment opportunities each year, but typically only spend a significant amount of time on 5-10 companies. Working with our existing portfolio companies is typically more steady and predictable. We generally help them think through strategy, assist them with their financial forecasting and help them evaluate investment opportunities.

Source: PWC

JF: I work in a three person “deal team” as the analyst. I am responsible for determining the value/price of the companies that we want to acquire. The process of determining the value of a company involves looking at company financial trends/projections , assessing the value of a competitor or comparable companies, reading research, speaking with industry experts and meeting with company management. Once we decide to move forward with an investment, I help create an investment memo to present to an internal committee (within my company), which provides formal investment approval.

Q: Tell us about “the good, the bad, and the ugly” of your role?

MA:

The Good:

It’s challenging and the learning curve never flattens out.

When things are going well, it can be really exciting. Making money for your investors feels good. Also, working with companies and helping them grow and improve is very fulfilling.

You get excellent exposure very early in your career.

Most firms are very team-oriented.

The Bad:

This is not a 40 hour work week gig. The hours can be long for stretches at a time.

The Ugly:

It can be a lot to manage and at times can be quite stressful.

JF:

The Good:

I enjoy looking at a diverse group of companies.

I am constantly learning about new industries and different business models.

The Bad:

The job requires patience. Because we typically staff one analyst per deal and we are very selective in which deals we pursue, sometimes an analyst sees a large number of deals before a good one crosses his/her desk. But hey, every good batter needs to wait for his pitch!

The Ugly:

There are a decent number of back office and marketing tasks that fall onto our desks. I’m passionate about private equity investing and so I love learning about new companies and industries. Therefore when my time gets taken up by the operational aspects, I find it less stimulating.

Q: What skills have you developed in your role?

MA: By far the most useful skill one learns in private equity is how to quickly and efficiently determine if an industry is attractive and if a particular company presents an exciting investment opportunity. More broadly, you can also expect to develop a strong analytical skill set, valuable presentation experience and interpersonal skills.

JF: Analytical skill set - I've learned to assess the strengths of companies, understand the viability of businesses in a possible recession scenario and develop and deliver an investment thesis and presentation

Q: What skills do you have to have to be successful in your role?

MA: You need to have a genuine interest in exploring new industries and companies, and an overall eagerness to learn. A knack for numbers helps as well. You’ll also need the skills that are required to succeed in pretty much any industry: outstanding work ethic, positive attitude, reliability and ability to multitask / manage a lot at the same time.

JF: Attention to detail, financial accounting, and presentation skills

Q: What do you enjoy most and least about your job?

MA: I love learning about new industries and businesses, and meeting experienced founders and executives. The stress that comes with the job can be overwhelming at times, which is something that I am still getting used to.

JF: I enjoy working with intelligent people and analyzing companies. Making an investment decision is like putting pieces together in a puzzle. It's a challenge but very rewarding once the puzzle is solved. Working at a big bank does not offer the same work-life balance perks such as those offered at tech companies. Where is my free lunch and nap pod?!